Automated adverse financial history check made easy

Adverse financial history check - the easy background credit check

An adverse financial history check reveals details of a candidate’s negative credit history that may provide insight into a candidate’s sense of financial integrity and financial responsibility. This check is country-specific, and we can investigate one or more territories.

These checks analyze the candidate’s credit score, debt, and bankruptcy records to understand his/her financial history and make an informed decision on whether or not to hire the candidate.

With automated adverse financial checks or credit checks, businesses can help mitigate the risk of fraud and ensure compliance with all candidates who will have direct access to a company or client’s finances or who will have the ability to authorize payments.

Our adverse financial history checks include:

- Adverse financial information, for example, missed payments

- Bankruptcy and individual voluntary arrangements

- Court Judgements on financial matters

Trusted by the world's best workplaces

PROVEN

.png)

.png)

and Loved by reviewers

Easy

Reduce risk

No lock-in

Global checks

24/7 support

Faster time to hire

With our award-winning software, we’re the number one choice for leading brands and workplaces all over the world.

Our adverse financial history check service is a simple process of investigating any past or present adverse financial issues that could influence how an individual conducts themselves in a business. These checks are particularly important in roles that have direct access to a company or client’s finances or who will have the ability to authorize payments.

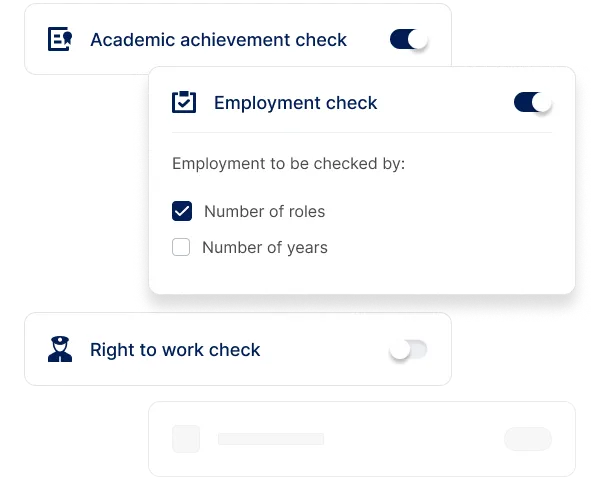

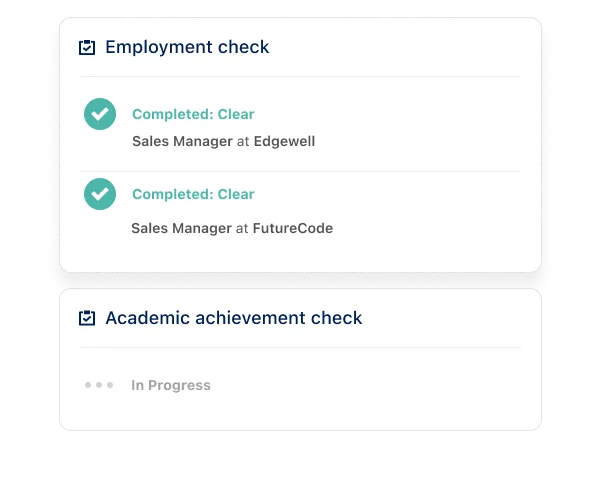

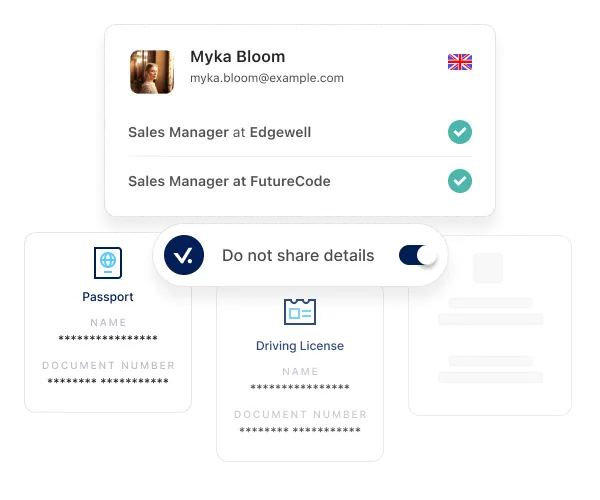

Integrations into your existing HR workflows mean this type of record can be combined with other confidential data to assess a candidate’s eligibility to work within the organization.

How it works

Related checks

FAQs

Adverse Credit will affect your Credit Rating and your ability to take out finance. This information will remain on your Credit Report for six years from the date of account closure, after which it will be automatically removed.

Employers will also see any past financial history on credit checks. This includes the number of open loans you currently have, the outstanding balance for those loans, any bankruptcies or collections. They’ll even see your finances on social media with the rise of background checks.

A credit check is a detailed report on a person's or a company's finances. The report spans from the last several years and covers all types of borrowing, loans, mortgages, credit cards and so on.

An adverse credit check is an important pre-employment screening check that can be used to assess potential risks or concerns. It will cover any serious adverse credit history the applicant has no matter how minor.

Transform your hiring process

Request a discovery session with one of our background screening experts today.