Determine the fitness and propriety of individuals working in regulated financial services.

Fit and proper tests - maintain the integrity and stability of your financially regulated company.

The FCA Fit and Proper Test is an assessment conducted by the UK’s Financial Conduct Authority (FCA) to determine the fitness and propriety of individuals holding key positions within regulated financial services firms.

This test is a crucial component of the FCA's regulatory framework and is designed to ensure that individuals in significant roles have the necessary skills, knowledge, integrity, and financial soundness to perform their duties effectively and in the best interests of consumers and the market as a whole.

The Fit and Proper Test evaluates various factors, including an individual's qualifications, competence, experience, honesty, and reputation.

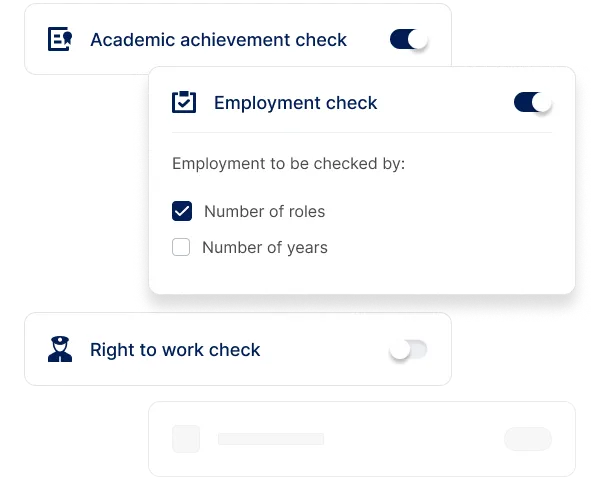

Our fit and proper test:

- Collects information about an individual’s honesty, integrity, reputation, capability, and financial soundness utilizing a questionnaire-based test

- Covers questions regarding criminal proceedings, civil proceedings, business and employment matters, conflict of interest, regulatory and other matters

- Informs employer of any red flags uncovered in the report

Trusted by the world's best workplaces

PROVEN

.png)

.png)

and Loved by reviewers

Easy

Reduce risk

No lock-in

Global checks

24/7 support

Faster time to hire

With our award-winning software, we’re the number-one choice for leading brands and workplaces all over the world.

In the financial sector, 100% compliance is crucial. Veremark’s fit and proper test questionnaire complies with both the Financial Conduct Authority and the Prudential Regulation Authority.

All Senior Managers and Certification Regime (SMCR) firms are required to conduct this test in order to verify a staff member’s capability and trustworthiness to perform a controlled function or high-responsibility role. These same firms are also required to continuously assess the ongoing fitness and propriety of applicable staff.

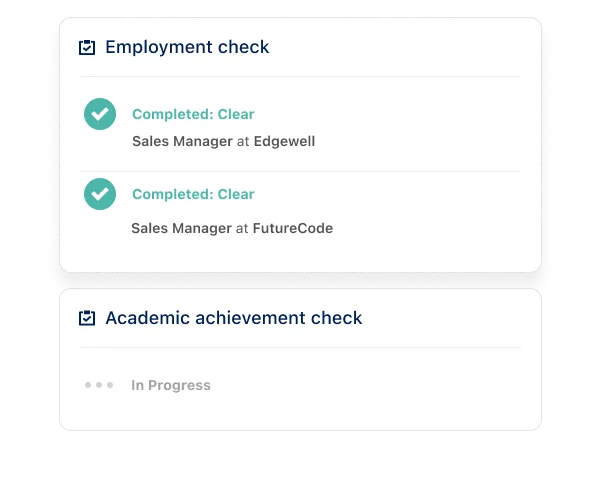

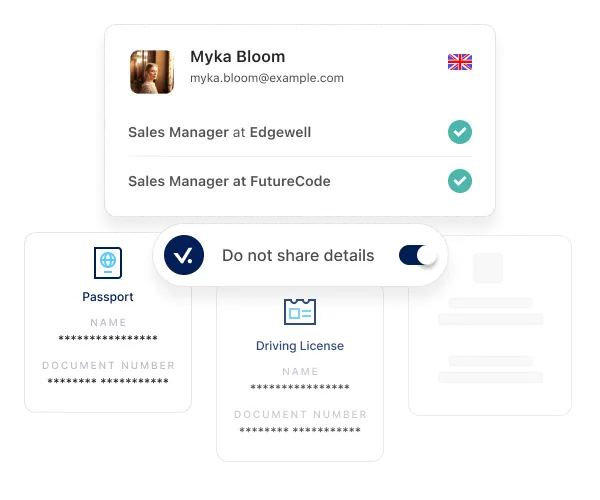

The end result is a report, sorted by topics, that presents the individual’s responses to each question and provides notes for any red flags or items to be aware of.

Integrations into your existing HR workflows mean this type of record can be combined with other confidential data to assess a candidate’s eligibility to work within the organization.

How it works

FAQs

The FCA Fit and Proper Test is an assessment conducted by the UK’s Financial Conduct Authority (FCA) to determine the fitness and propriety of individuals holding key positions within regulated financial services firms. This test is a crucial component of the FCA's regulatory framework and is designed to ensure that individuals in significant roles have the necessary skills, knowledge, integrity, and financial soundness to perform their duties effectively and in the best interests of consumers and the market as a whole.

The Fit and Proper Test evaluates various factors, including an individual's qualifications, competence, experience, honesty, and reputation. It assesses their ability to comply with regulatory requirements, manage risks, and maintain high standards of conduct. The test applies to individuals in senior management positions, key control functions, and other significant roles within regulated firms.

By conducting the Fit and Proper Test, the FCA aims to promote trust and confidence in the financial services industry and protect consumers from potential harm. It helps ensure that individuals entrusted with important responsibilities meet the necessary standards of professionalism and ethical conduct, contributing to the overall integrity and stability of the financial sector.

The Fit and Proper Person requirements, also known as the Fit and Proper Test, are regulatory standards and criteria set by financial regulatory authorities to assess the fitness and propriety of individuals holding key positions within regulated financial services firms. These requirements act like an honesty and integrity test and aim to ensure that individuals in significant roles have the necessary qualities and characteristics to perform their duties effectively and maintain the integrity of the financial system.

While specific Fit and Proper Person requirements may vary across jurisdictions and regulatory bodies, they typically cover several key areas:

Competence and Capability: Individuals should possess the skills, knowledge, qualifications, and experience relevant to their roles. They should demonstrate the ability to effectively carry out their responsibilities and stay up-to-date with industry developments.

Integrity and Honesty: Individuals should exhibit high standards of honesty, integrity, and ethical conduct. They should have a track record of good character and be able to handle their duties with integrity and professionalism.

Financial Soundness: Individuals should have the financial soundness necessary to fulfill their responsibilities. This may involve assessing their financial history, including creditworthiness and solvency, to ensure they are not exposed to financial pressures that could compromise their role.

Regulatory Compliance: Individuals should have a strong understanding of regulatory requirements and be able to comply with relevant laws, regulations, and codes of conduct. This includes adhering to anti-money laundering (AML) and know-your-customer (KYC) obligations.

Reputation and Conduct: Individuals should have a good reputation and demonstrate a history of responsible conduct in their personal and professional lives. Regulatory bodies may consider any past disciplinary actions, criminal records, or conflicts of interest.

The Fit and Proper Person requirements are essential for safeguarding the interests of consumers, maintaining market integrity, and ensuring the overall stability of the financial services industry. By assessing the fitness and propriety of individuals in key positions, regulators aim to promote trust, transparency, and accountability within the sector.

The specific questions asked during an FCA (Financial Conduct Authority) Fit and Proper Test may vary depending on the role, responsibilities, and regulatory requirements involved. However, here are some common areas and sample questions that may be covered in an FCA Fit and Proper Test:

Personal Information:

Can you provide details of your full name, address, date of birth, and contact information?

Have you ever used any other names or aliases?

Qualifications and Experience:

What is your educational background, including degrees, certifications, or professional qualifications?

Describe your relevant work experience in the financial services industry.

Have you completed any specific training or courses related to your role?

Regulatory Compliance:

Are you familiar with the FCA's regulatory framework and the rules applicable to your role?

How do you ensure compliance with regulatory obligations and ethical standards in your work?

Have you ever been subject to disciplinary action or investigation by a regulatory authority?

Integrity and Character:

Have you ever been convicted of a criminal offense or involved in any civil proceedings?

Are there any bankruptcies, insolvencies, or financial difficulties that could affect your role?

Can you provide references from previous employers or professional contacts to attest to your character?

Financial Soundness:

Do you have any outstanding debts or financial obligations that could impact your role?

How do you manage conflicts of interest, particularly in relation to personal finances?

Fit and Proper Declaration:

Are you aware of any factors that could affect your fitness and propriety to perform the role?

Have you provided complete and accurate information in your application?

These are just examples of potential questions that may be asked during an FCA Fit and Proper Test. The actual questions may vary based on the specific requirements and nature of the role you are applying for. It is advisable to review any guidance or materials provided by the FCA and seek professional advice to adequately prepare for the test.

Transform your hiring process

Request a discovery session with one of our background screening experts today.